In an era where digital disruption and shifting consumer expectations redefine industries, retail banking stands at a crossroads. Customer centricity – the practice of aligning every aspect of a business around delivering exceptional value to customers and the company alike – has emerged as the cornerstone of sustainable success. For banks, this means transcending transactional relationships to build trust, loyalty, and long-term engagement. By embedding customer-centric strategies into their DNA, retail banks can navigate competitive pressures, foster innovation, and secure their place in the future of financial services.

WHY CUSTOMER CENTRICITY MATTERS IN RETAIL BANKING

Retail banking is no longer just about providing financial products; it’s about solving customer problems and anticipating unmet needs. Traditional banks face unprecedented challenges from fintech disruptors and evolving regulatory landscapes. A customer-centric approach enables institutions to differentiate themselves by prioritizing personalized experiences, seamless digital integration, and proactive service.

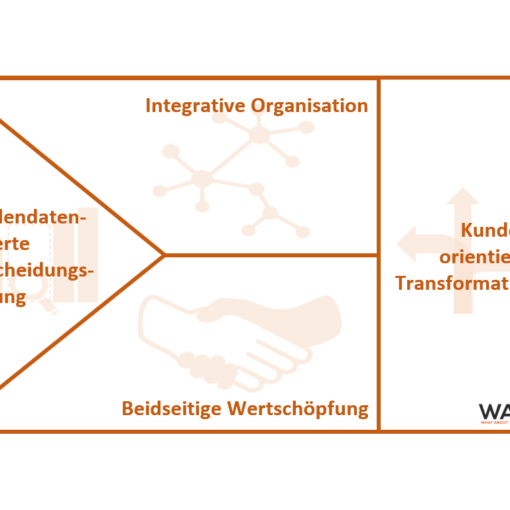

FOUR PILLARS OF CUSTOMER-CENTRIC TRANSFORMATION

- Decision-Making Aligned to Customer Needs

Every strategic choice – from product development to channel optimization – must start with customer insights. This requires leveraging data analytics to understand behaviors, preferences, and pain points. - Organizational Agility

Silos hinder responsiveness. Banks need cross-functional teams empowered to act swiftly on customer feedback, ensuring consistency across touchpoints. - Value Creation Beyond Profit

Customer-centric banks measure success not just by short-term financial metrics but by customer lifetime value, satisfaction scores, and advocacy rates. This shift fosters deeper relationships and sustainable growth. - Continuous Evolution

Regular assessments using tools like WATC Consulting’s Customer Centricity Scorecard help track progress, identify gaps, and adapt strategies to stay ahead of market trends.

SEVEN STEPS TO ENHANCE CUSTOMER CENTRICITY

- Conduct a thorough audit of current customer interactions and internal processes.

- Define clear customer-centric objectives tied to business outcomes.

- Train employees at all levels to prioritize customer needs in daily operations.

- Integrate technology that enhances personalization (e.g., AI-driven recommendations).

- Establish feedback loops to refine offerings iteratively.

- Communicate successes internally to reinforce cultural change.

- Monitor long-term performance through balanced scorecards.

THE BENEFITS OF CUSTOMER CENTRICITY

Banks that embrace this philosophy see measurable benefits: higher retention rates, increased cross-selling opportunities, and stronger brand equity. In a sector where trust is paramount, placing customers at the heart of strategy isn’t just ethical. It is economically imperative.